Table of Contents

- What's Going On with the Iran Economy?

- What's the Big Picture for the Iran Economy?

- Where Does Iran Get Its Money From?

- What Hurdles Does the Iran Economy Face?

- How Are People Feeling About the Iran Economy?

- What's the Iran Economy's Connection to the World?

- What's Next for the Iran Economy?

- Is the Iran Economy Really in Trouble?

- Keeping Up with the Iran Economy

When we talk about the Iran economy, it's a bit like looking at a quilt made from many different kinds of fabric, some quite colorful and others a little faded. This particular country has a way of managing its money that mixes central planning with a big chunk of public ownership, you know, where the government holds a lot of the reins. It's a place where oil and gas play a really big part, but there are also farms, service businesses, factories, and money services all contributing to how things run.

For anyone trying to keep tabs on what's happening with money matters in this part of the world, there's a lot to consider. We see how much stuff the country makes, how quickly prices go up, what they buy and sell with other countries, and how the government spends its cash. It's all part of a larger picture, and honestly, that picture keeps shifting, so it's quite a challenge to keep up, as a matter of fact.

You see, the Iran economy has its own set of things that make money matters tough, along with some chances for growth, and what might happen next, especially when we think about things like international limits on trade, prices going up really fast, and efforts to make the money system less dependent on just one or two big things. It's a story with many layers, and pretty much, it keeps unfolding.

- Scarswonderland Leak

- Amazing Race Season 26 Where Are They Now

- Kelly Ripa Son

- Russia Tass News

- Bill Cosby Characters

What's the Big Picture for the Iran Economy?

A Look at Iran Economy's Foundations

The way the Iran economy is set up, it's a blend, really. It’s got this big public part, so a lot of the important stuff is controlled by the government. Think of it, kind of, like a system where decisions about money are made in a central place. But it’s not just one thing; there are many parts that make it what it is. You have the oil and gas, of course, which are a really big deal. Then there are the farms, which provide food and other goods. Service businesses, like shops and places that help people, are also a piece of the puzzle. And, as a matter of fact, there are factories making things, plus all the financial services that help money move around.

It's interesting to note that over forty different kinds of businesses have their shares traded on the Tehran stock market. This means there’s a good bit of activity, with people buying and selling parts of companies. So, you know, while there's a lot of government involvement, there's also a market where private businesses play a role. It's a mixed bag, and that's actually quite common in many places around the globe, but here, the mix is pretty distinct.

This whole setup, with its various parts, paints a picture of a country trying to balance different ways of running its money system. It shows a desire to keep some control while also letting market forces do their thing, at least in some areas. And, too it's almost, this balance is always something that needs careful handling, especially given the various things that can impact how money flows in and out of the country.

- Danish Rapper

- Texas Am Baseball Score

- Ash Kash Leak

- Brattygbaby Porn Leaks

- Zach Braff Movies And Tv Shows

Where Does Iran Get Its Money From?

The Energy Strength of Iran Economy

When you think about where the Iran economy gets a lot of its financial muscle, it's pretty clear that oil and gas are a huge part of it. This country has a lot of oil that we know about, like ten percent of the world's confirmed oil in the ground. And when it comes to natural gas, it holds about fifteen percent of what's out there. So, you know, that makes it a really important player when we talk about energy on a global scale. This position as a major energy provider means it has a lot of natural wealth that it can, in theory, use to power its money system.

This abundance of natural resources gives the Iran economy a kind of backbone. It's what allows it to bring in a lot of money from other countries, assuming it can sell these resources. Because of this, what happens with oil prices and how much oil and gas it can actually sell has a really big impact on how well the country's money system is doing. It's like, if you have a big orchard, your income depends a lot on how many apples you can pick and sell, and for what price. Here, the "apples" are oil and gas, and they are pretty much everywhere.

However, relying so heavily on these kinds of resources can also be a bit of a tricky thing. If the world price for oil drops, or if there are reasons why the country can't sell as much as it wants, then that big source of money can shrink pretty fast. So, while it's a huge strength, it also means the Iran economy can be quite sensitive to things happening outside its borders. It's a powerful asset, but one that needs careful handling, as a matter of fact.

What Hurdles Does the Iran Economy Face?

Pressures on the Iran Economy

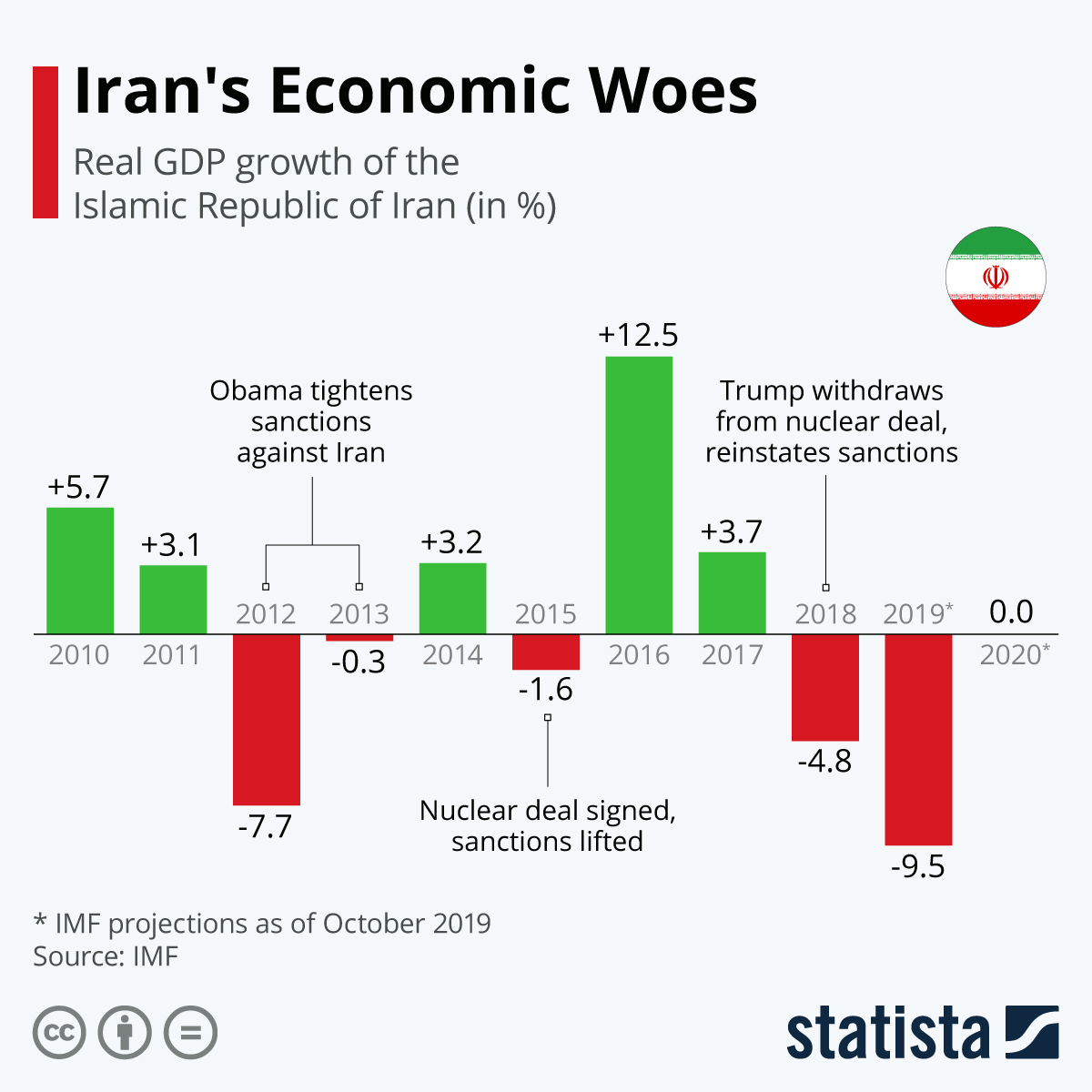

The Iran economy, you see, has quite a few things that make money matters tough for it. One of the biggest things is something called sanctions. These are like rules put in place by other countries that limit who Iran can trade with and what it can buy or sell. This makes it really hard for the country to do business with a lot of the world, which then means less money coming in. On top of that, there's been a lot of inflation, which means prices for everyday things just keep going up, making it harder for people to afford what they need. And, in a way, the country is trying to spread out its money-making efforts so it's not just about oil, but that's a big project.

Looking ahead to 2025, there are talks about a really serious money problem. People are saying there could be super fast price increases, a lack of energy, and the government spending more money than it takes in. These kinds of things can make life really hard for regular people. It's like, when you can't get enough power to run things, or when the cost of food keeps climbing, that's a real struggle. This situation, you know, makes things quite difficult for the average family, and that's actually a very real concern.

A big part of why things are so tough comes from the way the country is run, the limits put on trade from outside, and how cut off Iran is from many other countries. These things have made the problems much worse. And, as a matter of fact, because of all this, people inside the country have become more and more unhappy, and there have been more public displays of that unhappiness. It's a cycle where money problems lead to people being upset, which then makes it even harder to fix the money problems. It’s pretty much a tricky situation all around.

How Are People Feeling About the Iran Economy?

Public Sentiment and the Iran Economy

When you hear about the Iran economy, it's not just about numbers and big policies; it's also about how people on the street are feeling. The National Council of Resistance of Iran, for instance, talks a lot about these money problems. They point to the limits on trade, the way things are managed, and how isolated the country is as the main reasons for the difficulties. And, you know, these are things that touch everyone's daily life, from the cost of food to whether there are jobs available. It’s a very personal experience for a lot of people.

Their reports often cover specific areas that really hit home for regular folks. They talk about what's happening with the oil industry, which is so important for the country's income. They also look at things like social security, which is about making sure people have a safety net. Then there's the situation in the countryside, where farming communities might be struggling. And, in some respects, they mention energy shortages, which can mean blackouts or problems getting fuel. All these things paint a picture of daily struggles for many, and that's actually quite concerning.

What's more, they highlight the government spending more than it brings in, which is a big sign of trouble for any money system. When you combine all these things – the trade limits, the way things are run, the feeling of being cut off – it's easy to see why people might be feeling quite frustrated. It’s like, when your own wallet feels lighter every day, and you see the bigger picture isn't getting better, that really affects your mood. This widespread unhappiness, you know, becomes a very real part of the overall money situation.

What's the Iran Economy's Connection to the World?

Global Ties of the Iran Economy

The Iran economy, in a way, just keeps struggling because of the limits put on it by the United States and also because things inside the country aren't very stable politically. This means that, for a while now, there hasn't been much growth, prices are still going up fast, and a lot of people can't find work. It’s like trying to run a race with weights tied to your ankles; it just makes everything so much harder. And, you know, these external pressures really shape what the country can and cannot do on the world stage.

According to what the World Bank says, the country's money system is set to shrink by a small amount, about 1.6 percent, over the next twelve months. This is largely because it's having a tough time selling its goods to other countries. If you can't export, then you can't bring in that foreign money, which is really important for a country's financial health. So, basically, new businesses that are starting up mostly end up selling their services to people within the country, because selling outside is just too hard.

The biggest problem facing the Iran economy, honestly, is that it's still pretty much cut off from the rest of the world. This isolation isn't just about other countries putting limits on trade; it's also, in some respects, because of a sort of distrust of outsiders from within. This feeling of being apart from the global money system makes it very difficult to get the kind of investment and trade that could help it grow. It's a cycle, you know, where being cut off makes things tough, and tough things make it harder to connect. And, as a matter of fact, this challenge remains a very significant one.

What's Next for the Iran Economy?

Future Directions for the Iran Economy

The Iran economy is, basically, in a tough spot right now. You can see it in some very simple numbers, like how fast prices are going up, how little the economy is growing, and how the value of its money, the rial, keeps dropping. It's like, if your household budget keeps getting squeezed from all sides, and your income isn't growing, that's a sign of real trouble. And, you know, these are not just small problems; they are pretty fundamental to how the money system works.

In 2024, the total value of all goods and services made in Iran, what we call the GDP, was about 436.91 billion US dollars. This number comes from official figures from the World Bank. To put that into perspective, that's just a tiny piece, like 0.41 percent, of the entire world's money system. So, while it's a big number on its own, it shows that the Iran economy is a relatively small player in the global scheme of things. And, actually, that small share means it can be more affected by bigger global changes.

One thing that's really changed for the Iran economy is how much it relies on China. This has gone up a lot, to levels we haven't seen before. Now, a huge portion, like 92 percent, of its oil exports are going to this one Asian country. This kind of reliance, you know, means that if anything changes with that relationship, it could have a very big impact on Iran's money flow. It's like putting almost all your eggs in one basket, which can be a bit risky, as a matter of fact.

Is the Iran Economy Really in Trouble?

Signs of Strain in the Iran Economy

The Iran economy's current money problems have reached a very serious point. They are so big, in fact, that they are overshadowing other things the country might be trying to do in its part of the world. It's like, when you have a huge financial burden, it's hard to focus on anything else. We even saw a recent change where the person in charge of money and finances was let go, which often happens when things are not going well. And, you know, that kind of change often signals deeper issues.

Someone named Amin Shojaei, who writes about these things, gave his thoughts on what the Iran economy might look like in 2025. He pointed out that over the last few decades, this country's money system has faced a lot of tough situations. These include those international limits on trade, how much oil prices go up and down, and how unstable the money rules have been. It's been a bumpy ride, to say the least, and these past struggles really set the stage for what's happening now. And, basically, it's a long history of financial ups and downs.

This writer looked at the Iran economy at the start of 2025, especially thinking about how it fits in with what's happening with money matters globally and in the surrounding area. He has, in fact, written before about how valuable things like gold and silver can be a kind of safety net when stock markets are shaky and money is losing its value. So, the idea is that people might look for other ways to keep their wealth safe when the usual money system is facing big problems. This perspective, you know, suggests people are looking for stability in uncertain times.

Keeping Up with the Iran Economy

Staying Informed on the Iran Economy

For those who want to keep up with what's happening with the Iran economy, there are places that give you the latest updates. For example, Iran Focus offers breaking news about money matters in the country. It's a way to get information as it happens, so you can stay in the know. And, you know, in a situation where things are changing quite often, having access to fresh information is pretty important. It helps you get a sense of the daily pulse of the country's money situation.

The Iran Economic Monitor, or IEM, also provides updates on important money developments and what policies are being put in place. This kind of information helps people understand the bigger picture of how the country is trying to handle its money system. It’s like getting a regular check-up on the financial health of a place, which is actually very helpful for anyone trying to follow these events. And, as a matter of fact, knowing the policies helps you guess what might happen next.

Looking at 2025, the Iran economy is dealing with very deep problems in its basic structure. These problems, honestly, are the result of many decades of things not being managed well, those international limits on trade, and a lot of bad dealings within the system. Trading Economics, for example, gives you information on millions of money indicators from nearly two hundred countries, including actual numbers, what experts think will happen, past trends, and news. So, you know, there are many ways to try and piece together what's happening and what might be coming next for the Iran economy.

Related Resources:

Detail Author:

- Name : Joshua Shields

- Username : kreiger.lysanne

- Email : lindgren.dina@hotmail.com

- Birthdate : 2006-01-22

- Address : 40504 Hodkiewicz Meadow Hermannbury, MS 53042-1353

- Phone : 1-410-482-4268

- Company : Dickens LLC

- Job : Order Clerk

- Bio : Deleniti iure ea est. Minus optio corrupti nesciunt et ut quos qui. Cumque necessitatibus ab autem delectus modi veritatis fuga. Modi odio assumenda aliquam impedit dolorem ipsam et nostrum.

Socials

tiktok:

- url : https://tiktok.com/@loraine.adams

- username : loraine.adams

- bio : Ea reprehenderit accusantium laudantium dolores.

- followers : 1662

- following : 348

instagram:

- url : https://instagram.com/loraine.adams

- username : loraine.adams

- bio : Ut id voluptatem ipsam cum. Eius molestiae sint autem asperiores iste iste.

- followers : 4030

- following : 1092