Many people wonder, what is Barclaycard, and why does it matter? It’s basically a big name in the world of credit cards, a part of Barclays, a financial institution that’s been around for a very long time, offering financial tools to folks across the globe.

This particular brand, stylized as Barclaycard, holds a pretty special place, especially in the United Kingdom. It’s actually recognized as the very first credit card provider there, and it has grown to be the largest, serving millions of people, you know, helping them manage their daily spending and bigger purchases too. This history, in a way, shows a lot about its presence and how many people rely on it for their everyday money needs.

So, whether you are in the UK or perhaps even in the US, where it has also had a presence, knowing a bit more about what this brand offers can be helpful. It’s about more than just plastic; it’s about a way to handle your money, pay for things, and sometimes even get some extra perks along the way, which, to be honest, can be pretty neat.

Table of Contents

- What is Barclaycard - The Core Idea

- How does a Barclaycard work - Your everyday money tool?

- What is a Credit Card - The Basics

- What are the benefits of Barclaycard - Beyond just spending?

- Where can you use a Barclaycard - Network Reach?

- How to manage your Barclaycard - Tools and Support?

- What about Barclaycard in the US - A Different Approach?

- What is the Barclays Consumer Spend Index - A Look at Spending Habits?

- Is there a Barclaycard for you - Matching your needs?

What is Barclaycard - The Core Idea

So, when someone talks about Barclaycard, they are actually talking about a specific brand that belongs to Barclays PLC. It's not a separate company, you know, but rather a part of a much bigger financial group. This means it comes with the backing and experience of a very established global bank, which can give people a good feeling of trust and stability when they are thinking about their finances. It’s kind of like a specialized service offered by a larger parent company.

This particular brand has a rather significant place in financial history, especially in the United Kingdom. It holds the distinction of being the very first credit card provider in that country. Think about it, that’s a pretty big deal, actually. It means they were pioneers in bringing this type of financial product to people there. And not only were they first, but they have also grown to become the biggest credit card provider in the UK, with a huge number of accounts, something like five million active users. That many people choosing to use their services really says a lot about its reach and how widely accepted it is across the nation, more or less.

A credit card from Barclays, then, is simply a piece of plastic money, or rather, a financial account, that is given out by Barclays. This is the multinational bank that has its main home base in London. So, when you get a Barclaycard, you are essentially getting a card from this well-known bank, which means you are connected to a large, international financial institution. It’s pretty straightforward, really, just a part of their overall offerings to customers.

How does a Barclaycard work - Your everyday money tool?

If you happen to have a Barclaycard, it’s basically a credit card that you can use for a whole bunch of things in your daily life. You can use it to buy stuff, whether that's groceries, clothes, or maybe even something a bit bigger. You can also use it to pay your bills, which can be really convenient for things like your utilities or subscriptions. And sometimes, you know, if you find yourself in a pinch and need some actual cash, you can even use it to get some money when you need it, which can be a lifesaver in certain situations, honestly.

When you go about using your Barclaycard for these different transactions, like buying things or paying bills, all of those activities eventually show up on your bank statement. This means you get a record of everything you’ve spent, which is pretty useful for keeping track of your money and making sure you are staying within your budget. It’s how the bank keeps tabs on what you owe and helps you keep track of your spending too, so you can see where your money is going, basically.

What is a Credit Card - The Basics

In its most basic form, a credit card is a special kind of account that a financial institution, like a bank, gives to a consumer. This account then lets that person buy things or pay for services using borrowed money, or "credit." The cool thing is that you don't have to pay for it all right away. Instead, you can pay back the amount you used over a period of time. It sounds pretty simple, and in a way, it is, but there are some details that make it a bit more involved.

While the idea of buying now and paying later seems easy enough, there are quite a few things that go into figuring out how much credit you are allowed to have, and also what it will end up costing you over time. This isn't just a random guess, you know. To make this decision, a financial institution looks very closely at a number of factors about you and your financial situation. They assess things like your payment history, how much money you earn, and other financial details to decide what kind of credit limit makes sense for you and what the terms of borrowing will be, which is pretty important to understand, really.

What are the benefits of Barclaycard - Beyond just spending?

Your Barclaycard, it turns out, is packed full of various things it offers and advantages that can be pretty helpful. One of the really good ones is something called purchase protection. This means that if you buy something with your card and it gets lost, stolen, or damaged soon after you buy it, you might be covered, which is a nice bit of reassurance, you know, when you are spending your money. It’s a bit like having an extra layer of safety for your purchases.

But that's just one thing it offers. There are often many other advantages that you can get just by being a cardholder. These can vary a lot depending on the specific card you have, but they might include things like rewards points, cashback on your spending, or special deals and discounts with certain retailers. It's worth taking a moment to learn more about all the other good things you can get from your particular card, because, honestly, some of them can be pretty valuable and add up over time.

Where can you use a Barclaycard - Network Reach?

When you have a Barclaycard, it’s usually set up to work on either the Visa or Mastercard network. This is a pretty big deal, actually, because these are two of the largest payment networks in the entire world. What that means for you is that your card will be accepted in a huge number of places, whether you are shopping online, in a physical store, or even when you are traveling abroad. It gives you a lot of freedom and convenience, knowing that your card will likely be accepted wherever you go, which is pretty handy, really.

So, whether you are hoping to find a card that helps with your hotel stays, or perhaps one that gives you some benefits when you buy flight tickets, or even if you are planning a cruise, there’s likely a Barclaycard option that fits. They have different types of cards that are designed with various preferences in mind, so you can often find something that matches your particular needs. It's about finding the right tool for what you want to do with your money, you know, whether it’s for big trips or just a little bit of everyday spending.

In the United States, Barclays has also given out cards under the Barclaycard brand for a while. But they also have cards that are connected with big names in the travel industry, like major airlines, popular hotel chains, and even cruise loyalty programs. This means that even if you don't see a regular "Barclaycard" branded card in the US, you might still be using a card that is issued by Barclays through one of these partnerships, which is pretty interesting, actually, how they work with other companies.

How to manage your Barclaycard - Tools and Support?

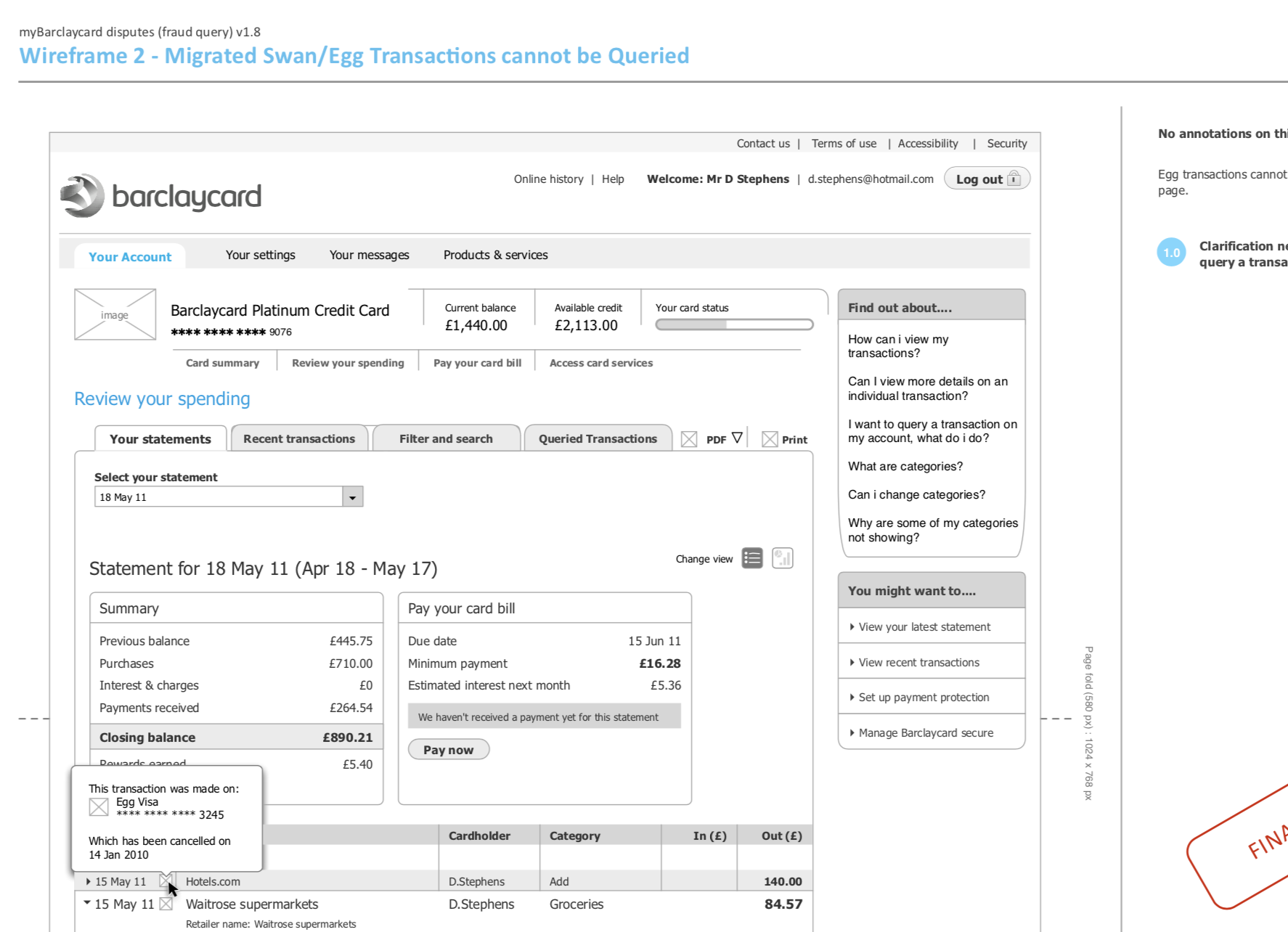

The Barclaycard online account has a lot of really helpful tools, so you can handle your account in a way that suits you best. This means you can check your balance, see your recent transactions, pay your bills, and even update your personal details all from your computer or phone. It’s designed to give you a lot of control and make managing your money simpler, which is pretty important for most people, you know, in this day and age.

To get started with managing your account online, you just need to go to the Barclaycard website. From there, you can either register for an online account if you haven’t already, or simply log in if you already have your details set up. It’s usually a straightforward process, letting you get access to all those handy features pretty quickly, so you can keep an eye on your finances whenever you need to.

If you ever have any general questions about your account or need some help, you can usually get in touch with Barclaycard by calling a specific phone number. For instance, the number 0333 200 9090 is often given for these kinds of general and account queries. It’s good to know there’s a direct line if you need to speak to someone. For other ways to pay your bill, or if you happen to have a special Amazon Barclaycard, it’s usually best to visit their website online to see all the contact information and options available for those specific situations, which can vary a bit.

What about Barclaycard in the US - A Different Approach?

Even though Barclays no longer offers credit cards in the United States under its own direct brand name, like a standard "Barclaycard" you might recognize from the UK, it still has a very significant presence in the country. In a way, it remains one of the largest companies that issues credit cards in the US. This is mostly because of its many partnerships with big businesses, such as airlines, various stores, and other types of organizations. So, while you might not see a card simply called "Barclaycard" in the US, you could very well have a credit card from your favorite airline or store that is actually issued by Barclays, which is pretty cool, honestly, how they work behind the scenes.

What is the Barclays Consumer Spend Index - A Look at Spending Habits?

Across their various businesses that handle card issuing and processing payments, Barclays gets to see a really large chunk of what people are buying. They actually see nearly half of all the credit and debit card transactions happening in the nation. This gives them a truly special way of looking at how people in the UK are spending their money. It’s like having a huge window into the spending habits of a whole country, which is pretty unique, you know, for understanding the economy.

These insights, which come from all that transaction data, are then combined with research that looks at how consumers are feeling about things. This "consumer sentiment research" helps them get a fuller picture. So, it's not just about what people are buying, but also about their attitudes, their hopes, and their worries about money and the future. Putting these two pieces of information together helps them capture a really detailed picture of consumer behavior, which is very useful for understanding the broader financial landscape, actually.

Is there a Barclaycard for you - Matching your needs?

If you are looking to improve your credit score, or perhaps you want to bring together different credit balances and store card balances into one place, or maybe you are just hoping to get some rewards or cashback on your everyday spending, there could very well be a Barclaycard that is a good fit for you. They have a range of options, and it’s about finding the one that matches what you are trying to achieve with your money, which is pretty helpful, you know, to have choices.

You can find out more about what's available, check if you are eligible for a particular card, and even apply online to get a decision almost instantly. This makes the process pretty quick and simple, letting you know where you stand without a long wait. It’s about giving you access to the right financial tool for your specific situation, whether that’s for big goals or just daily convenience, so it’s worth looking into, honestly.

A credit card is often seen as just a way to borrow money, but it can actually be more than that. It can offer various potential advantages compared to using cash or a debit card. For instance, besides the purchase protection we talked about, some cards offer rewards, help you build a credit history, or provide a convenient way to manage larger purchases over time. It’s worth exploring these other potential good things that can come from using a credit card, as they can sometimes offer more than just a means to pay for things.

The Barclays help center is also a good place to find answers to your questions about what is Barclaycard. They have frequently asked questions sections, especially for Barclays US consumer bank credit cards, covering everything from general queries to specific questions about payments. This means if you have a question, there's a good chance you can find an answer there, which is pretty useful for getting quick information.

This article has explained what Barclaycard is, starting with its identity as a brand of Barclays PLC and its historical significance as the UK's first and largest credit card provider. We've covered how a Barclaycard works for everyday purchases and bill payments, and clarified the basic concept of a credit card itself. The discussion also touched upon the features and benefits a Barclaycard offers, such as purchase protection, and its broad acceptance through the Visa or Mastercard networks. We looked at how to manage a Barclaycard account online and the available customer support. Furthermore, the article explained Barclays' different approach in the US market through partnerships and introduced the Barclays Consumer Spend Index, which offers insights into UK spending habits. Finally, it considered how different Barclaycard options might suit various personal financial goals, like improving credit scores or earning rewards.

Related Resources:

Detail Author:

- Name : Janessa Macejkovic

- Username : azieme

- Email : bziemann@maggio.com

- Birthdate : 1993-03-07

- Address : 5761 Keeling Views Suite 835 North Ellenton, DE 13367

- Phone : +18627039859

- Company : Smitham-Bogan

- Job : Usher

- Bio : Quia debitis quia iusto qui nobis animi quam veniam. Soluta minus iusto dolor assumenda est aut. Consequatur exercitationem deleniti et eius doloribus quae.

Socials

tiktok:

- url : https://tiktok.com/@don_xx

- username : don_xx

- bio : Eaque odio nihil nesciunt ducimus vel ab.

- followers : 2741

- following : 1324

twitter:

- url : https://twitter.com/don_real

- username : don_real

- bio : Pariatur temporibus voluptas quibusdam. Animi voluptas quasi fuga molestiae placeat eius impedit. Voluptates voluptatem ab sit.

- followers : 2164

- following : 2085

instagram:

- url : https://instagram.com/don_o'keefe

- username : don_o'keefe

- bio : Ut dolorem odio ducimus non. Deleniti quam consequatur pariatur earum.

- followers : 4769

- following : 2514

linkedin:

- url : https://linkedin.com/in/o'keefe1975

- username : o'keefe1975

- bio : Deserunt rerum quos eos non.

- followers : 4400

- following : 2126

facebook:

- url : https://facebook.com/dono'keefe

- username : dono'keefe

- bio : Est dolore voluptatum quidem ducimus.

- followers : 732

- following : 172